german tax calculator berlin

Ad File your German tax return in just 17 minutes. Income tax bracket 2022 married couple Tax rate.

Everything You Need To Know About Income Tax In Germany

First add your freelancer income and business expenses to the calculator.

. This Income Tax Calculator is best suited if you. German Wage Tax Calculator. In the results table the calculator displays all tax.

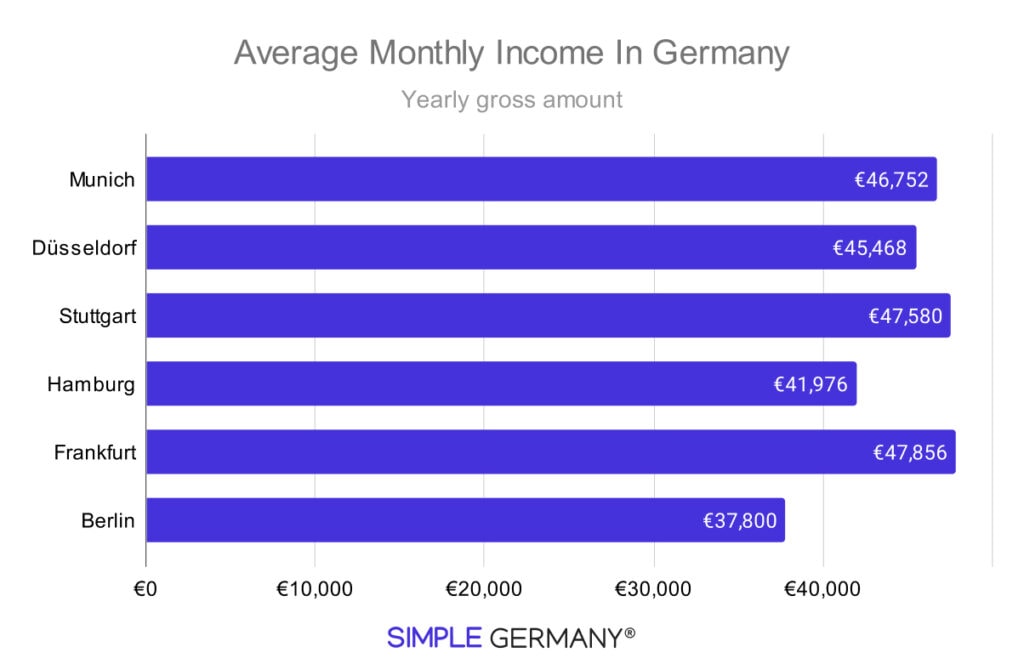

A minimum base salary for Software Developers DevOps QA and other tech professionals in Germany starts at 40000 per year. This is quite a bit lower than the average. The tax rate is calculated as a percentage of the sale price and varies from state to state.

The average median gross salary in Berlin is 42224 according to 2022 figures. Gross Net Calculator 2022 of. This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2022.

The median income in Berlin is 41800 per year 1. For this example I assume that you also have to pay. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions.

This is how married couples registered partners are taxed in Germany if they do a joint tax declaration. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. This Wage Tax Calculator is best.

It is very easy to use this German freelancer tax calculator. The median income in Germany is 41125 per year. All you have to do is select the federal state in which you reside and.

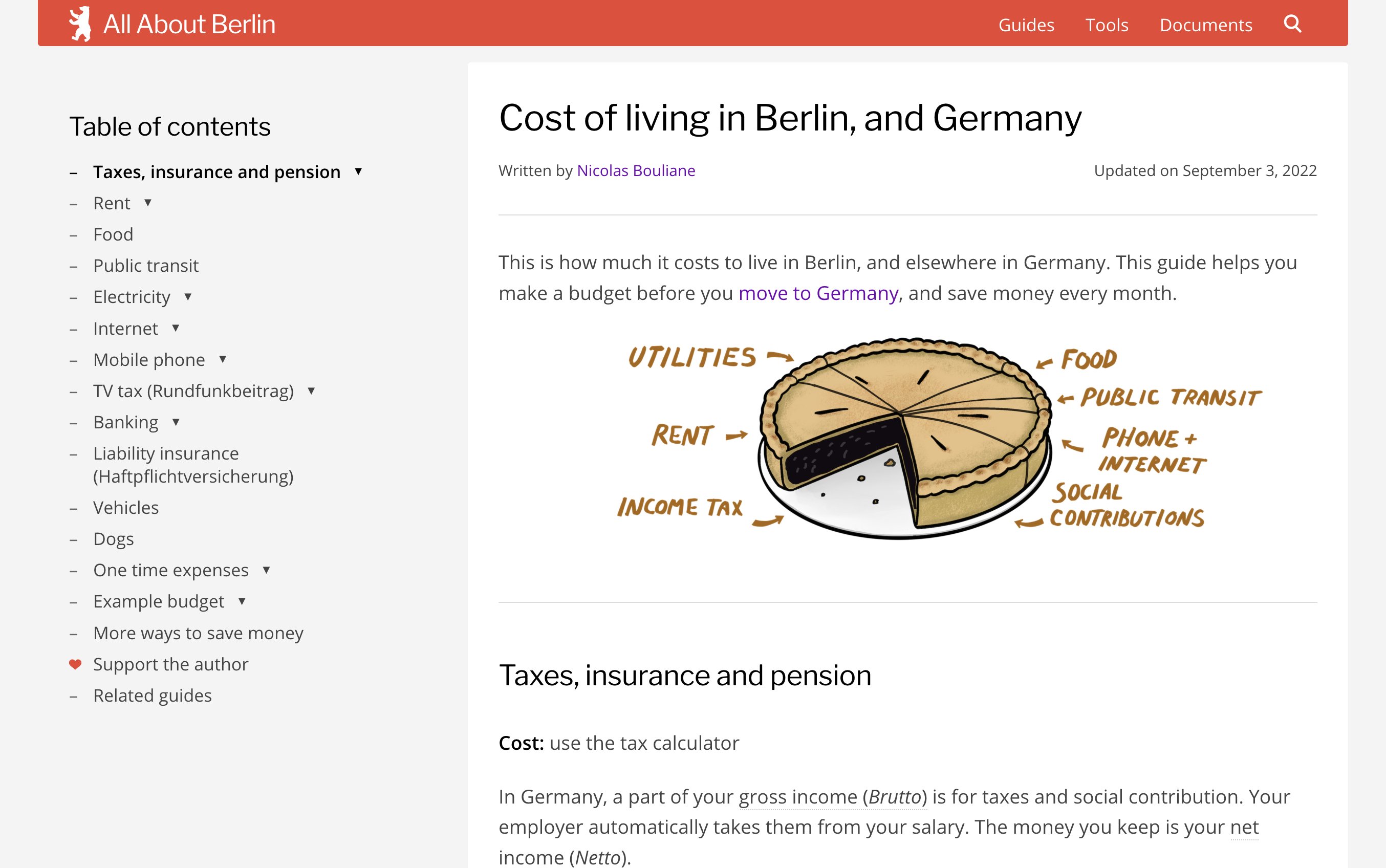

After taxes that comes out to 27878 annually or 2323 a month. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. About this German salary calculator.

Use our salary tax calculator to calculate income tax and your netto earnings. Berlin salaries are lower than in other German cities 1 but the cost of living. This German salary calculator is designed to give you a pretty good estimate of how much you can expect to take home after taxes and.

You can enter the gross wage as an annual or monthly figure. The SteuerGo Gross Net Calculator lets you determine your net income. Free Brutto Netto Calculator Germany.

In other states the tax rate varies. If you wish to calculate your salary Social. In Berlin the property transfer tax rate is set at 6.

Get 1051 back on average from your German tax return. Our German tax calculator Steuerrechner can estimate your take-home salary and total taxes due in just a few clicks. For both instances I will assume a monthly gross salary of 3500 Euros in the accounting year 2022 the tax class 3.

This will generate your estimated amount for your Profit. Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of. Annual gross income 34000.

Secure your tax refund now. 1881 2005.

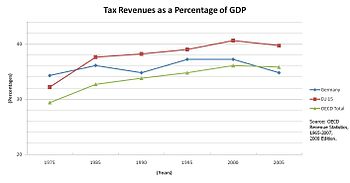

Taxes In Germany Vs Us Full Comparison 2022

Is 60 000 Euros A Good Salary In Germany Quora

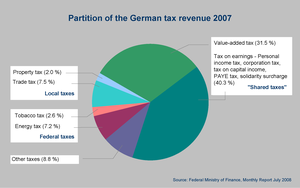

Taxation Of Partnerships In Germany

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

What Is Considered A Good Salary In Germany Detailed 2022 Guide

Taxes In Germany Vs Us Full Comparison 2022

Tweets With Replies By All About Berlin Aboutberlin Twitter

Employment Taxes In Germany Boundless Eor

Premium Photo German Income Tax Return Form With European Euro Money Bills And Calculator Lies On Accountant Table Close Up The Concept Of Taxpaying Period In Germany

Explained How To Save Money On Your Taxes In Germany

What Is Left After Tax For A 53 Salary In Germany Quora

Treaty Between Germany And Oman Details Orbitax Tax News Alerts