fsa health care limit 2021

8 days ago Health Care FSA Maximum Plan Limit. For plan year 2022 in which the.

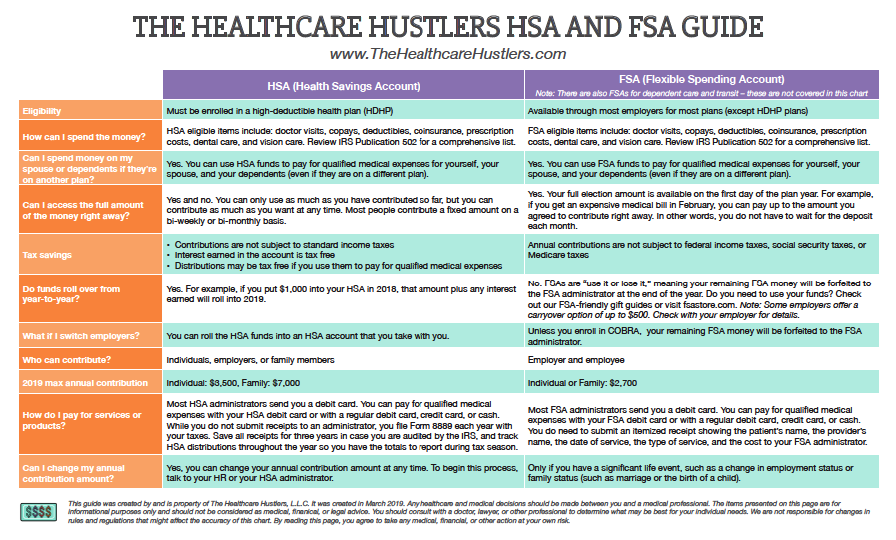

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Unlike the health FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by.

. Aged 65 and older or Medicare eligible. This pre-tax benefit account helps you save on eligible out-of-pocket dental and vision care expenses while taking advantage of the long-term savings power of an HSA. IRS Announces 2021 Health Care FSA Limits Employee.

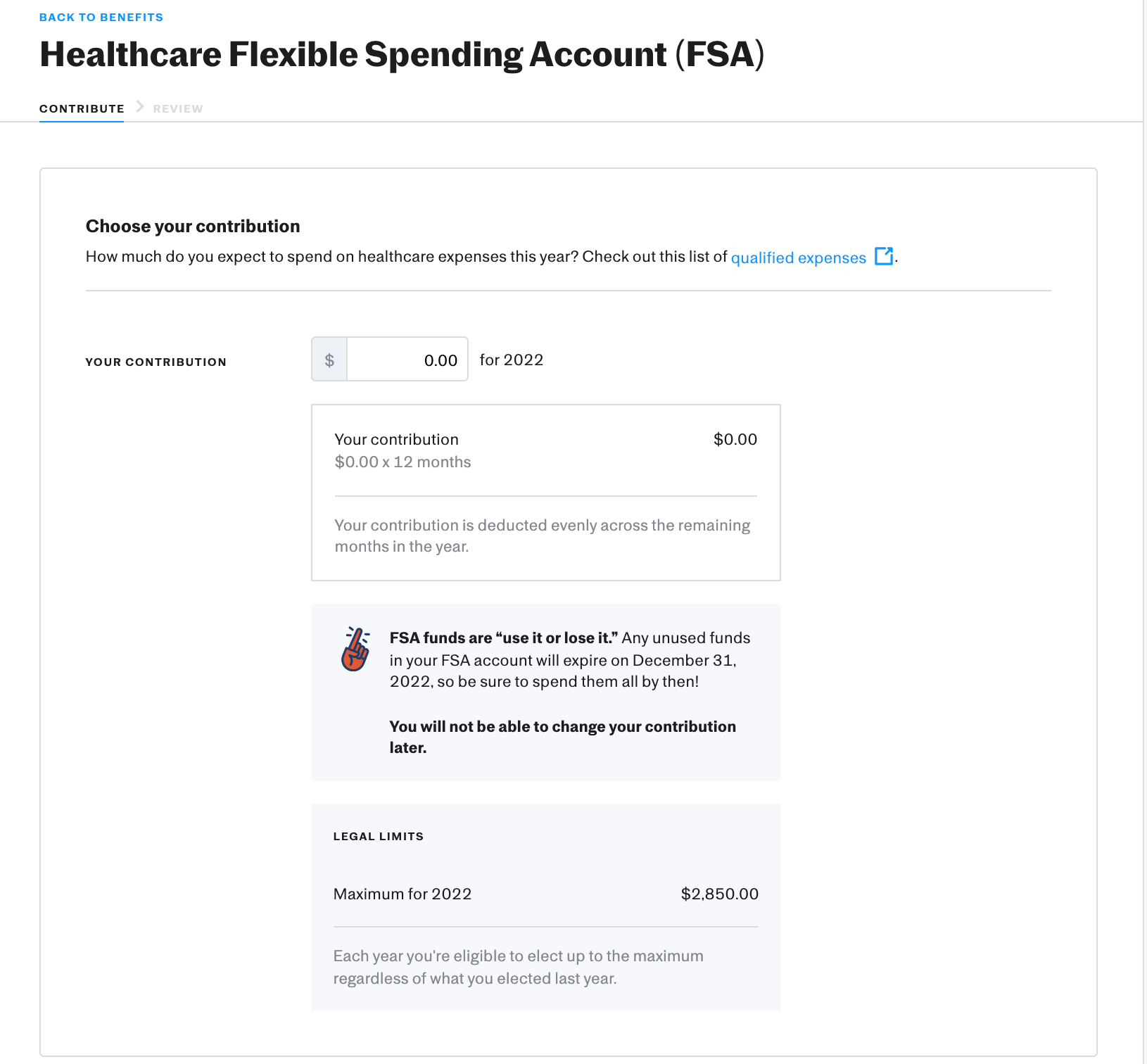

Employers may allow participants to carry over unused amounts. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

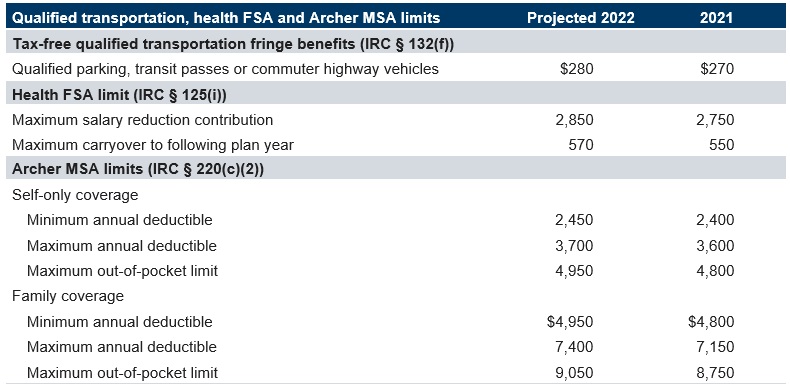

However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to. Health savings accounts HSAs HSAs are only available to members enrolled in a PEBB consumer-directed health plan CDHP. Plus if you re.

Health 8 days ago Included in the announcement is the inflation adjusted 2021 limits for Health Care flexible spending accounts. Individual adults ages 19 up to 65. Dependent care FSA limits remain unchanged at 5000.

The carryover amount of unused health FSA funds is increased to 550 up 50 from the 2020 limit of 500 for 2021. IR-2021-40 February 18 2021. For spouses filing jointly each spouse can elect up to the health care max in the year in 2022 that would be 2850 2850 5700 household total.

Dependent Care FSA Limits Remain the Same for 2021. You can use your HSA to pay for IRS-qualified out-of. The health FSA contribution limit will remain at 2750 for 2021.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. The pre-tax salary reduction limit for Health Care FSAs will remain at 2750 for plan years on or after January 1 2021. WASHINGTON The Internal Revenue Service today provided greater.

Aged blind or disabled.

Health Care Fsa Limit Projected To Remain The Same For 2021 Employee Benefits Corporation Third Party Benefits Administrator

What S The Difference Between An Fsa And An Hsa First Dollar

What Is An Fsa Unitedhealthcare

What The New 2022 Hsa Limits Mean For You The Difference Card

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

Charlotte Savings And Spending Accounts

Irs Announces Health Fsa Limits For 2021 M3 Insurance

.jpg)

Fsas Hras And Hsas Infographic Interlutions

Flexible Spending Accounts Or Fsas What To Know Before You Opt In Contribute Or Spend

Irs Announces Increase For 2021 Fsa Contribution Limits

2021 Flexible Spending Account Other Limits Flexible Benefit Service Llc2021 Flexible Spending Account Other Limits

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Plan Limits Employee Benefits Corporation Third Party Benefits Administrator

Upmc Irs Announces Hsa Fsa And Hdhp Contribution And Oop Limits For 2021 Neishloss Fleming

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

Flexible Spending Accounts Healthcare Fsa Dependent Care Fsa Justworks Help Center